Sector Performance Analyzer: 8663214255, 4082752011, 120355798, 8323550000, 790501501, 8645645889

The Sector Performance Analyzer provides critical insights into investment decisions through its comprehensive metrics. It evaluates key indicators such as revenue growth and market share across various sectors. By analyzing these figures, investors can better understand market dynamics and volatility. This tool’s ability to highlight trends is essential for aligning investment strategies with financial goals. However, the intricacies of its features warrant a closer examination to fully grasp its potential implications for strategic investment planning.

Understanding Sector Performance Metrics

Sector performance metrics serve as critical indicators for evaluating the financial health and growth potential of various industries within the market.

These sector metrics provide quantitative data that assists investors in identifying trends and making informed decisions. Performance indicators such as revenue growth, profitability margins, and market share enable a comprehensive analysis, fostering a deeper understanding of each sector’s dynamics and overall contribution to economic freedom.

Key Features of the Sector Performance Analyzer

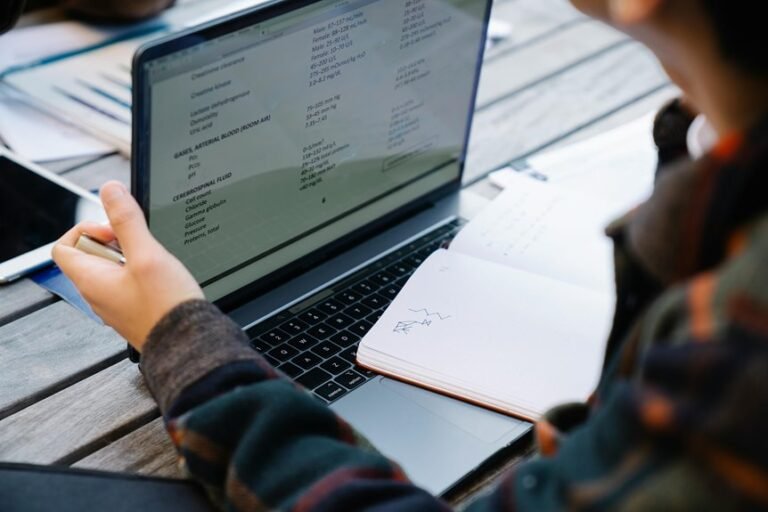

While investors seek to optimize their portfolios, the Sector Performance Analyzer offers essential features that facilitate a nuanced understanding of market dynamics.

Key functionalities include advanced data visualization tools, enabling clear insights into sector trends, and robust performance benchmarking, allowing users to compare sector performance against established metrics.

These features empower investors to make informed decisions, enhancing strategic portfolio management and market adaptability.

How to Utilize the Analyzer for Investment Strategies

Investors can leverage the capabilities of the Sector Performance Analyzer to refine their investment strategies by conducting detailed sector analysis.

This tool facilitates investment diversification by identifying underperforming sectors that may offer growth potential.

Additionally, it aids in risk assessment, allowing investors to evaluate volatility and correlation across sectors, thus empowering them to make informed decisions that align with their financial objectives and risk tolerance.

Analyzing Sector Trends and Market Opportunities

The identification of sector trends and market opportunities is pivotal for formulating effective investment strategies.

By leveraging market segmentation, investors can pinpoint specific areas exhibiting growth potential.

Trend identification enables stakeholders to assess evolving consumer behaviors and economic shifts, facilitating informed decision-making.

This analytical approach empowers investors to navigate complexities, optimizing their portfolios in alignment with emerging market dynamics and opportunities.

Conclusion

In conclusion, the Sector Performance Analyzer equips investors with essential insights, enabling them to measure performance, identify trends, and navigate complexities. By leveraging advanced metrics and data visualization, it empowers users to enhance decision-making, optimize portfolios, and align strategies with financial goals. As market dynamics continue to evolve, utilizing such analytical tools becomes paramount for informed investment choices, ensuring that stakeholders remain competitive and responsive in an ever-changing financial landscape.